What Is The National ICV Certificate And How To Apply For An ICV Certificate In Abu Dhabi Or Dubai, UAE?

Answers To All Your Queries On ICV Certificate And The National ICV Program Registration Process.

The National In-Country Value Program’s Objective was to enhance the performance of various industry sectors by boosting the contribution of the local industries to the national GDP. Strategic localization of supply chains and the development of new local industries and services, stimulating and attracting foreign investments, diversifying the economy, and increasing exports, creating valuable job opportunities in the private sector, contributing to the growth of national GDP, enhance spending on R&D and advanced technology and increase the private sector’s contribution to national GDP.

As part of the National ICV Program, suppliers are required to present their ICV Certificates with respect to the previous financial year, which evaluates their contribution to the local economy of the UAE. The certified suppliers get preference during the award of contracts and purchases. Their ICV scores play a major role in securing contracts and purchases. The ICV assessment forms an integral part of the tender evaluation and award process of the Partners of the Program.

The ICV Certificate is required to be certified by one of the certification providers on an annual basis.

Inspire MS Tax Consultancy is UAE’s leading company who provides the National In-Country Value (ICV) Program consultation.The Program’s strategic partners comprise a cluster of government entities and leading national and semi national companies in diverse fields, including the Program’s pioneers, Abu Dhabi National Oil Company (ADNOC).

Who Started The National In-Country Value Program?

The Abu Dhabi National Oil Company (ADNOC) Group of companies first launched The In-Country Value (ICV) certification to achieve their objectives. Their key goals were such as Emiratization, GDP Diversification and Strategic considerations. In the following years, different Government and semi-Government Companies joined the program to broaden the scope of the ICV certification process. The result was a Unified ICV program for Suppliers across various sectors in the UAE.

Towards the end of 2021, the Unified ICV program was renamed as the National In-Country Value Program (ICV) by the Ministry of Industry and Advanced Technology (MoIAT).

Here Are The Key Objectives Of The Program:

Development of new local industries and services with strategic supply chain localisation.

Diversifying the economy and boosting exports by encouraging and attracting foreign investments.

Increasing the volume of the private sector job market with job opportunities of great value.

Contribution to national GDP growth.

Enhanced private sector contribution for GDP growth.

Increased spending on R&D and advanced technology

Boost the contribution of the private sector’s to the UAE GDP

How To Get The ICV Certificate?

Only Professional firms authorised by the MoIAT are authorised to carry out the verification and issuance of the ICV Certificate. Professional firms such as Inspire MS Tax Consultancy are called Certifying Bodies, which provide ICV certification services in Dubai, Abu Dhabi and across the UAE.

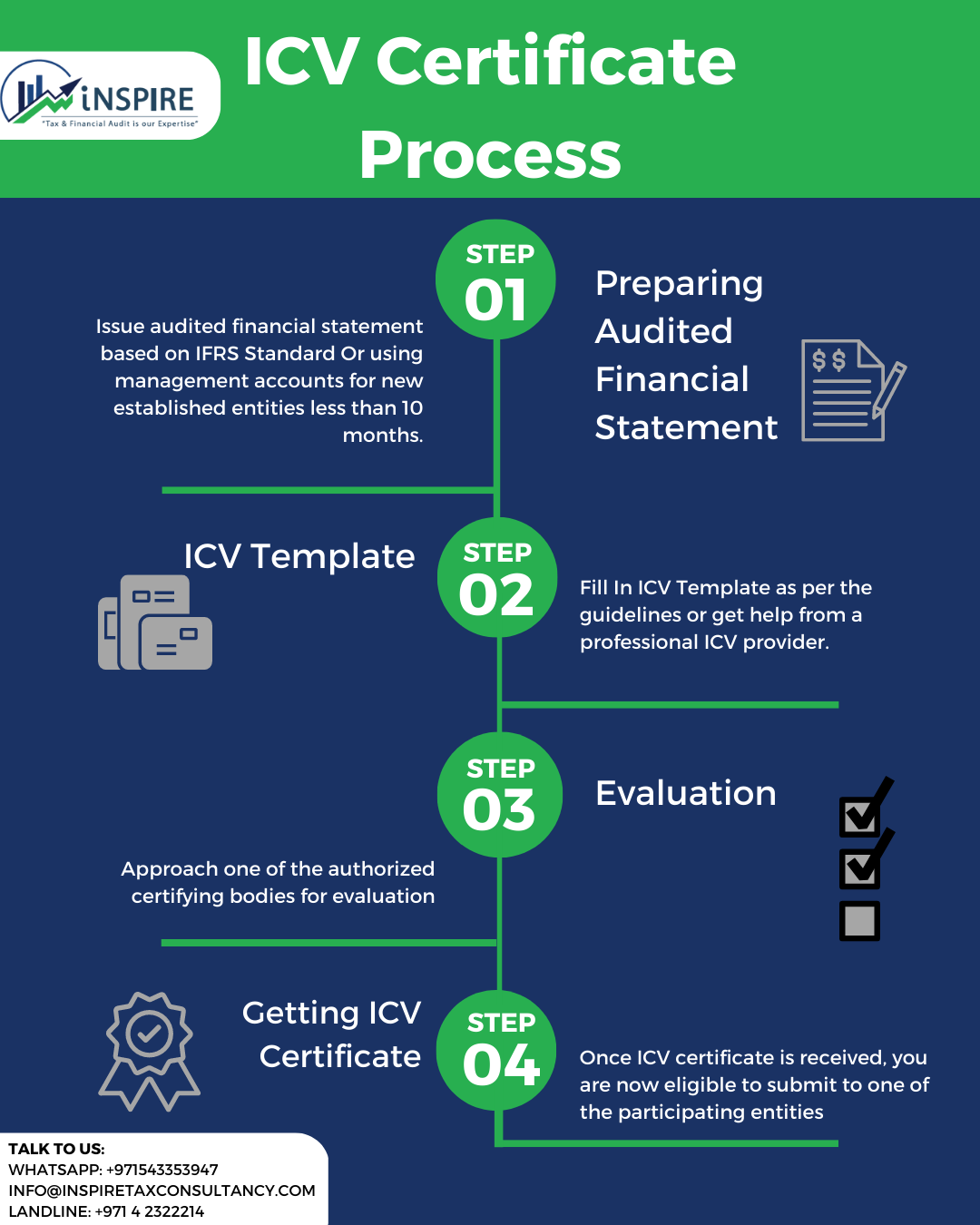

What Is The National ICV Certificate Process?

The process for ICV certification program is as follows;

Prepare audited financial statement: Issue audited financial statement based on IFRS Standard Or using management accounts for new established entities less than 10 months.

ICV Template: Fill in ICV Template as per the guidelines

Evaluation: Approach one of the authorized certifying bodies for evaluation

Getting ICV Certificate: Once ICV certificate is received, you are now eligible to submit to one of the participating entities.

What Companies Require An ICV Certificate?

Any Company inside or outside the UAE can obtain an ICV certificate in-line with ICV guidelines. As part of the National ICV program, any company that wishes to apply for a government or semi-government procurement opportunity will need to have an ICV certificate.

Suppliers directly providing goods or services to the partners of the program may be required to declare their ICV Score as this is an integral part of their tender evaluation and award process. Other suppliers may also be required to provide their ICV Certificate to ensure competitiveness in their tenders. The ICV factor accounts for a weightage in tender evaluation. However, this is not a mandatory requirement.

What Metrics Does The ICV Score Represent

The ICV Score reflects a Company’s value addition to the UAE economy. The Score is determined and presented as a percentage after taking the below factors into consideration:

Goods Manufactured

Third Party Spend

Investment

Emiratization

Expatriate Contribution

Bonuses:

Exports

Emirati Head Count in organization

Investment Growth

What Are The Key Factors To Look When Obtaining A National ICV Certification?

The MoIAT has set out a series of requirements for suppliers to achieve the ICV certification. You can also seek consultation from ICV certification service providers like Inspire MS Tax Consultancy

Below are some of the key considerations for the National ICV Program:

Audited Financial Statements, prepared in accordance with IFRS and not older than two years from the certifying year, and signed by a licensed auditor from the UAE Ministry of Economy. Get a professional financial audit

ICV certificates can be obtained for each legal entity of a group company. However, if a company has different branches in the same Emirate with identical activities and ownership, then a combined ICV certificate will be issued for the Company in that Emirate.

ICV certificates will be issued separately for companies with manufacturing and commercial licences. All accounting records must be split between the two when obtaining.

If you are a company less than 10 months old and do not have audited financial statements, you can present management accounts for a period of up to 9 months for the ICV certification process.

The ICV certificate will be valid for 14 months from the date of issuance of audited financial statements.

How Much Does It Cost To Obtain A National ICV Certificate?

The cost for your ICV Certification will depend on the size of the company, nature of business and other criteria. This is due to the different processes required to be performed prior to ICV Certificate issuance.

Contact Us

For more information about our ICV Certification related services and advice, please contact us at;

Website: https://inspiretaxconsultancy.com/

email: Info@Inspiretaxconsultancy.com

WhatsApp: +971543353947

Landline: +971 4 2322214