UBO Filing Deadline for UAE Companies | Ultimate Beneficial Ownership

All Establishments registered in UAE are required to submit on or before 30 June 2021 for Ultimate Beneficial Ownership. Documents: Copy of License, Passport...Readout full information in the article

Deadline for UAE Companies to file UBO | Ultimate Beneficial Ownership Declaration 2021

First came the Value-Added-Tax (VAT), then Economic Substance Regulations (ESR), and now Ultimate Beneficial Owner (UBO) rules. The UAE now requires companies to strictly follow well-defined transparency procedures.

Who can be termed as Real Beneficiaries or Beneficial Owner?

"The ultimate beneficial owner (UBO) is the person who, directly or indirectly, controls and owns a company. Individuals with ownership of at least 25% shares or who exercises ultimate control over a 'legal person' like; someone with voting rights of a company or someone with the power to appoint and dismiss a majority of a company's directors shall be considered as a UBO."

What all documents need to be submitted or filed?

The companies incorporated after the resolution came into effect should report to the Registrar within sixty (60) days of formation. In the Real Beneficiary Register, they must provide:

- Full name, nationality, date, and place of birth;

- Place of address, or residence to which notifications are sent;

- ID number or Passport, country, and date of issue and expiry;

- Date and basis on which he became a real beneficiary; and

- The date on which a person ceases to be a real beneficiary.

The Partners or Shareholders Register (PSR) requires:

- Number and class of shares owned by each of the partners or shareholders;

- The date on which they become a partner or shareholder

The 'legal person' should submit any amendment or change to the details or information to the registrar within fifteen (15) days from the date of the amendment and change. And if the company is under liquidation, the liquidator shall hand over the Real Beneficiary Register and Partners or Shareholders Register to the Registrar within thirty (30) days from the date of his appointment.

How to file?

You have an option to upload the documents either in-person or online with outside service centers.

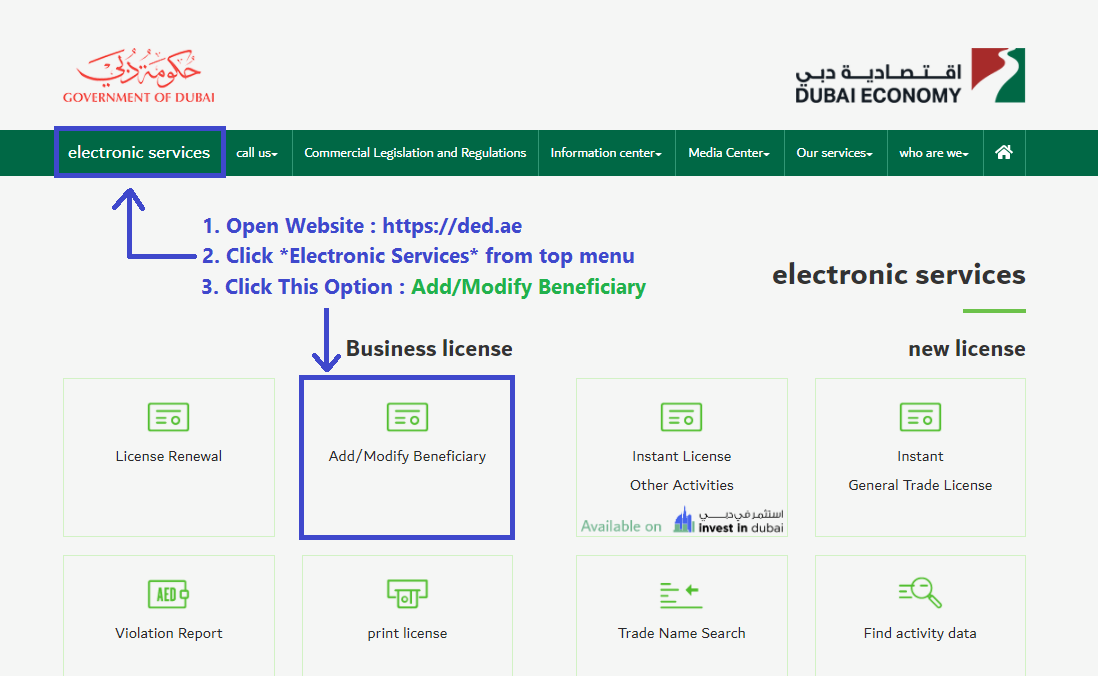

To submit documents online:

- Go to the website: https://ded.ae/

- Click *Electronic Services* from the top menu of the website

- Or skip step 1 & 2 and simply open this link (https://eservices.dubaided.gov.ae/Pages/Anon/GstHme.aspx)

- Then, Click on Add/Modify Beneficiary and Login with UAE Pass.

- This link is a user guide for the UAE PASS Application: https://www.mohap.gov.ae/Documents/Banner/UAEPASS_User_Guide_1.0.pdf

- Now Fill in the necessary data and upload the documents.

To submit documents in person:

- Go to the website: https://ded.ae/

- Click on *Call us* from the top Menu then select *Service Centers*

- You can see the list of Centers along with Worktime and other Details.

- The submission or filing should be done by the authorized person on behalf of the entity.

Deadline for UBO Filing in UAE: All Establishments registered in UAE are required to submit on or before 30th June 2021.

How Inspire Consultancy can help you?

Reach us to have a tension-free life in your journey in UAE. Our consultancy will assist you in taking care of all the procedures involved in the VAT process including the UBO process. Call us today for any kind of assistance at +(971) 504884714 / +(971) 543353947 or email us at info@inspiretaxconsultancy.com to get all your queries addressed.