How is VAT carried out on services got in designated zones in UAE?

Designated zones can be alluded to as the free zones which are excluded from the VAT system in UAE. These are unique domains that have VAT rules which are...

How is VAT carried out on services got in designated zones in UAE?

Designated zones can be alluded to as the free zones which are excluded from the VAT system in UAE. These are unique domains that have VAT rules which are more easy-going when compared to other areas. There are very nearly 30 free zones inside the UAE that draw in investors by giving them with tax reductions, and different relaxations in the working of their organizations. After introducing VAT in UAE, just about 20 of the free zones are viewed as designated zones.

One more vital thing is that investors should remember VAT applicability varies between designated free zones and non-designated free zones. One more place of significance is that the VAT relevance on services is not the same as the materialness on merchandise. The instance of merchandise bought inside the designated zone and outside the state is viewed as outside the extent of the VAT.

Standards to be satisfied to turn into designated zone in UAE

The accompanying situations should be satisfied to turn into a distinguished designated zone in UAE:

1 - It should be a fenced geological area.

2 - It should have strict safety efforts alongside control strategies to screen the movement, entry, and exit of merchandise and services.

3 - It should have strict inner systems for improving the strategy for keeping, putting away, and handling the products in the area.

4 - The VAT techniques set somewhere near the FTA should be conformed to by the operator.

What is the utilization of VAT on services in designated zone?

The central matter to recollect prior to understanding the use of VAT services in Dubai designated zones is that these zones are considered inside the UAE domain for delivering and getting services. Consequently, the VAT is carried out according to the general arrangements of UAE VAT regulation and chief guidelines set somewhere around the FTA.

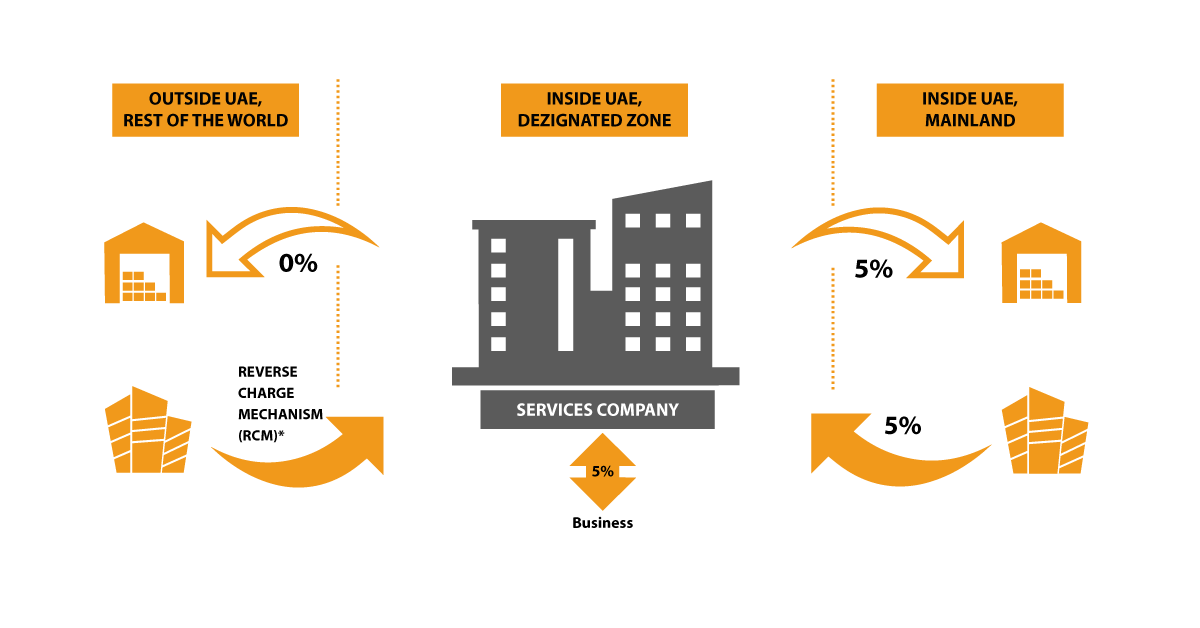

Presently we should understand the VAT application in designated zones, which can be sorted in various situations:

Situation 1:

At the point when services are gotten from one more designated zone,

If a service is delivered starting with one designated zone then onto the next, in such a situation, the VAT will be charged on the help at 5%. The standard pace of VAT is charged on the grounds that the spot of supply for a help is viewed as inside the state when it is delivered inside the designated zone.

Such as: Service given by EFG firm in Dubai Vehicles and Car zone to JKL firm in Dubai Aeronautics City will be charged VAT at 5% as these are services given between two designated zones

Situation 2:

At the point when services are gotten in the designated zone, they are delivered by UAE Central area

The VAT will be charged according to the ordinary VAT guideline when the help is gotten from the UAE central area, i.e., the typical pace of 5% VAT will be charged. As the UAE central area is likewise viewed as inside the state, numerous standard rates will be applied to the services gave.

Such as: IT services given by an organization DEF in Dubai Central area to a JKL organization in Jebel Ali Free Zone will be charged VAT at 5% as the exchange of services is between the designated zone and the central area.

Situation 3:

At the point when services are gotten from outside the UAE state,

As a piece of any business prerequisite, the organizations in the designated zone might get services from outside the UAE. In such conditions, the services will be available in view of an opposite charge system, i.e., the beneficiary of such services will be responsible to pay the duty when they document their VAT gets back with the power.

Such as: QPR firm in Jebel Ali free zone profited promoting services from IJK firm in the USA. In such a situation, the services got by the QPR firm will draw in charge on an opposite charge system at a 5% VAT rate. Consequently, the beneficiary, the QPR firm, should cover the duty.

How could Inspire Tax Consultancy help you in the execution of VAT and filing returns?

The firm that is located in UAE and executes business between various firms situated in various zones will need master help from an expense specialist in regards to the execution of VAT on various labor and products. Inspire Tax Consultancy, with its expertized group, furnishes VAT services in dubai alongside other imperative services like VAT return documenting, guaranteeing VAT consistence, and bookkeeping and examining services. Inspire Tax Consultancy is known for its powerful and exceptionally fitted services gave to its clients. To find out about the different services, go ahead and contact Inspire Tax Consultancy.